All-in-One Reputation Platform: Generate Reviews & Acquire Customers Automatically

AI-Powered Reputation Management Software for Local Businesses

"Reputation Management Software That Generates Google Reviews & Acquires Customers 24/7"

Automate 5-Star Google Reviews & Dominate Local Search

Get 3-5X More Google & Facebook Reviews Automatically

Our AI Review Engine transforms satisfied customers into your best marketing team by:

- ✅ Sending personalized review requests via SMS/email post-service

- ✅ Making 5-star submissions one-click easy (takes customers <30 seconds)

- ✅ Boosting local search rankings by 178%* (Google Maps & "near me" searches)

- ✅ Auto-responding to negative reviews with AI-crafted professional replies

❌ Manual Process

- 3-7 reviews/month

- 5+ hours/week managing

- 38% review rate

✅ With Our AI

- 25-40 reviews/month

- Fully automated

- 72% review rate

Generate authentic reviews automatically after every service with AI-optimized requests. Monitor and respond to all feedback from one dashboard to boost rankings and attract 47% more local customers

Messaging

Unified Inbox: Never Miss a Customer Message Again

❌ Separate Apps

- 38% missed messages

- 5+ hours response time

✅ Our Solution

- 92% message response rate

- <5 min average response time

Reach your customers wherever they are.

Payments

Fast, easy, secure payments.

All the tools you need to grow in one place.

Online Reviews

Automate your online reviews with a few simple clicks & respond to reviews in 1 place

Messaging

Manage your messages with a single inbox for text, Facebook messages, Google messages, and more.

Webchat

Convert more website visitors into leads & sales conversations with Webchat.

Payments

Easy text 2 pay client invoicing. Simplify your client invoicing & get paid faster.

Missed Call Text Back

When you're away, have USA web Reviews follow up via text so you never lose another customer

CRM

Grow your audience & know where

new leads are coming from

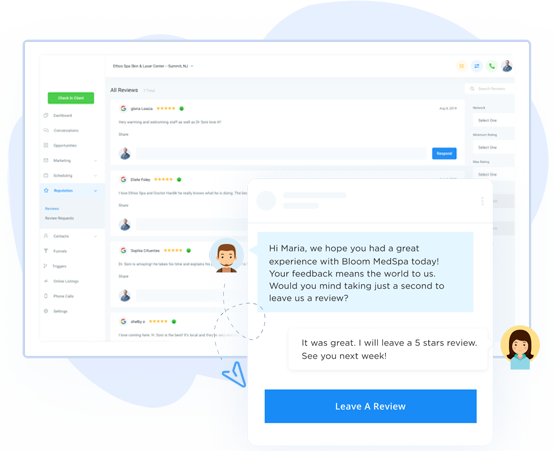

Online Reviews

Automate Your Online Reviews

Improve your ratings, build your reputation, and get found online by sending review requests via text to recent customers, responding to and interacting with reviewers, and managing it all from a single inbox.

Every Conversation In One Place

Communicate Efficiently With Customers and Leads

Reach your customers wherever they are with text messaging. Request reviews, connect with website visitors, collect payments, respond to Facebook & Google Messages, and market to customers and leads all from your app.

Get Paid Faster Than Ever

Collecting payments isn’t anyone’s favorite job. Make paying as quick and convenient as possible for your customers with a secure payment link delivered right to their phone.

Grow Your Audience

Grow your audience & know where new leads are coming from with USA web Reviews 's easy-to-use CRM. Easily import existing leads to make client communication a cinch!

Easily Integrates With Leading Apps

Book a Demo

Copyright USA web Reviews 2025 -- All Rights Reserved

We’re on a mission to build a better future where technology creates good jobs for everyone.